-

The column in the Fiscal Details table

-

The corresponding Report Builder field

-

The typical journal entry item associated with the field

-

The definition of the field

-

The debit and credit that corresponds to the item in the screen shots below

The scenarios on this page are typical, but they may not reflect your scenario. We cannot provide any specific recommendation for how your journal entries should look. We recommend you speak with your auditors to ensure that your accounting needs are met.

Toggle the Fiscal Details View

Toggle the Fiscal Details View

To toggle the Fiscal Details view of your accounting schedule:

-

Navigate to one of the six following pages.

Use the links in the Navigation Pane on the leftmost side of the page.

-

Contract > Accounting Info > ASC 842 Rent Schedule

-

Contract > Accounting Info > GASB 87 Rent Schedule

-

Contract > Accounting Info > IFRS 16 Rent Schedule

-

Equipment Contract > Accounting Info > ASC 842 Rent Schedule

-

Equipment Contract > Accounting Info > ASC 842 Equipment Schedules

-

Equipment Contract > Accounting Info > GASB 87 Rent Schedule

-

Equipment Contract > Accounting Info > GASB 87 Equipment Schedules

-

Equipment Contract > Accounting Info > IFRS 16 Rent Schedule

-

Equipment Contract > Accounting Info > IFRS 16 Equipment Schedules

-

-

Select the accounting schedule you want to view from the Rent Schedule List at the top of the page.

-

Select the Fiscal Details option below the Rent Schedule heading.

The Fiscal Details view of your accounting schedule opens.

Non-Calculation Column Definitions

Non-Calculation Column Definitions

| Column in Fiscal Details | Report Builder Field | Description |

|---|---|---|

| Year | Fiscal Period Year | The fiscal period year. |

| Period | Fiscal Period | The fiscal period. |

| Cumulative Period Number | Cumulative Period Number | The cumulative period number, where the period number increases by one with each subsequent period. |

| Period Length | Number Days | The length of the period in days. |

| Begin Date | Begin Date | The begin date of the period. |

| End Date | End Date | The end date of the period. |

| Status | Record Status | Indicates the posting status of the period. |

ASC 842 Scenarios

ASC 842 Scenarios

This section will show the typical journal entry scenarios for ASC 842 schedules. The only difference in how ASC 842 Finance and Operating schedules are allocated to journal entries is their period entries.

We highly recommend you perform an ASC 842 Test to determine whether your schedule should be Operating or Finance. You can perform this test in Lucernex on the ASC 842 Test tab.

Scenario One: Initial Entry

Scenario One: Initial Entry

Inception Entries

Inception Entries

Generally speaking, the initial asset and liability balances are used to populate the entries at inception.

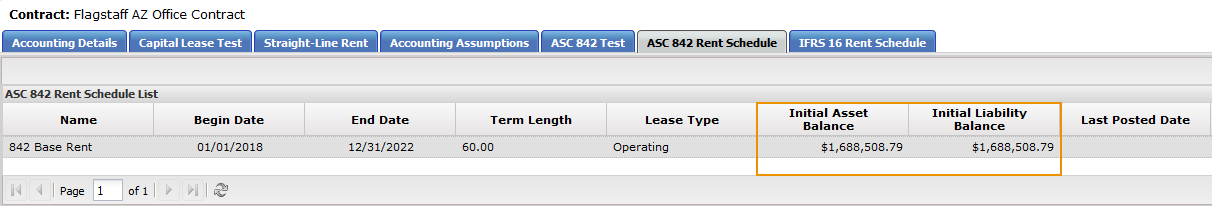

Pictured below is the ASC 842 Rent Schedule List. The Initial Asset Balance for the schedule is listed as $1,688,508.79 and the Initial Liability Balance is listed as $1,688,508.79.

The values in the Debit and Credit columns in the table below correspond with the screen shot above.

| Item | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

| Initial Asset Balance | Initial Asset Balance |

|

This is a calculated value which contains the initial value over the asset of the lease. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

$1,688,508.79 Debit to Initial Asset Balance |

|

| Initial Liability Balance | Initial Liability Balance |

|

This is the total of all of the Period Payment Present Values over the life of the lease. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

|

$1,688,508.79 Credit to Initial Liability Balance |

Period Entries - Finance

Period Entries - Finance

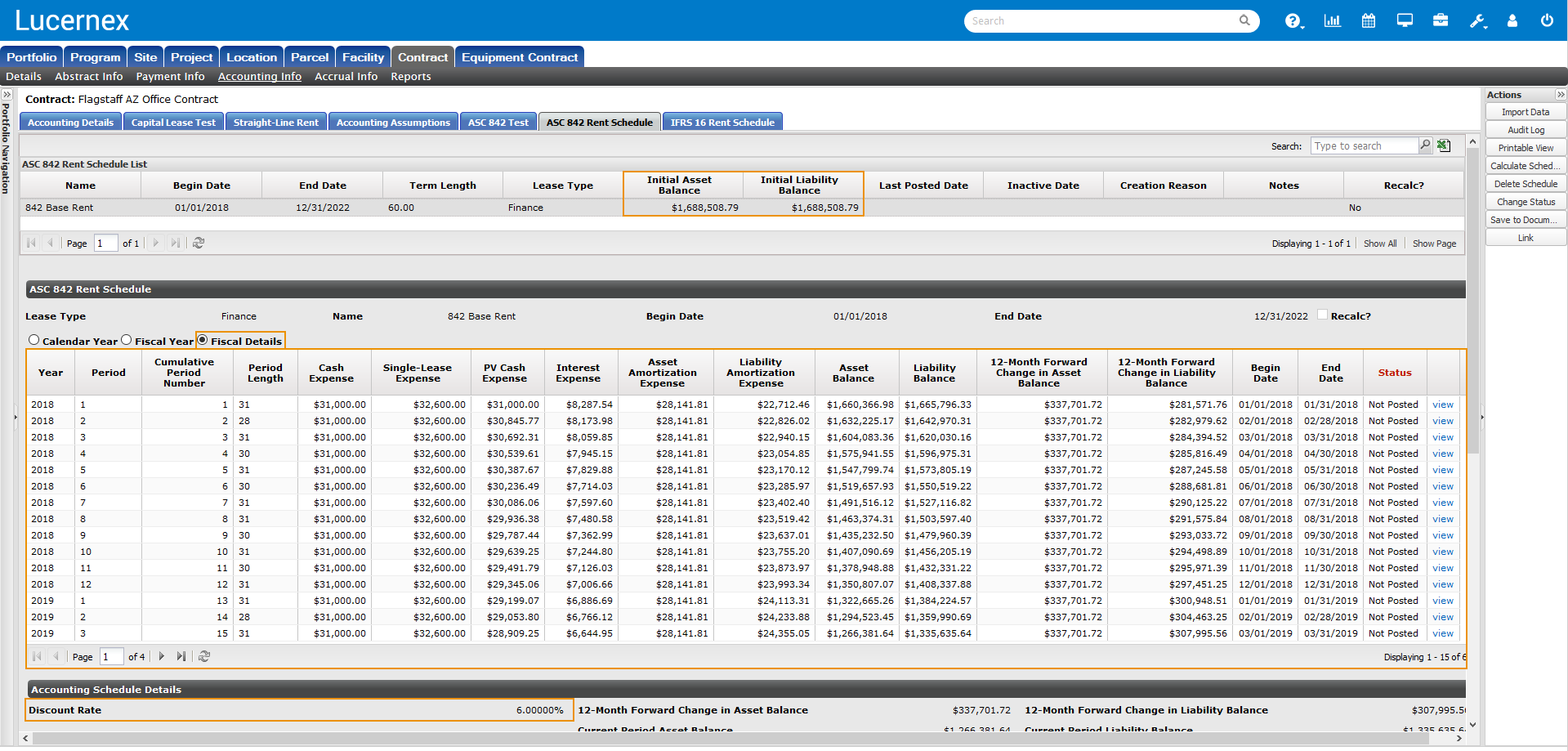

Pictured below is a screen shot of the Fiscal Details view of the Finance schedule we will be using in our example.

The table below shows the columns in the Fiscal Details table, their corresponding Report Builder field, typical journal entry item, description, and the debit and credit values for these items in Period 1 of the screen shot above.

The values in the Debit and Credit columns in the table below correspond with the screen shot above.

| Column in Fiscal Details | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

| Cash Expense | Period Cash Amount |

|

The amount of cash payments made during the period, fed directly from the recurring expense. |

$31,000.00 Debit to Liability |

$31,000.00 Credit to Rent Expense |

| Single Lease Expense | Period Expense Amount |

Not used in any journal entry for Finance schedules |

The cash rent straight lined over the life of the schedule. |

N/A |

N/A |

| PV of Cash Expense | PV Of Period Cash Amount | Not used in any journal entry | The Present Value of a future cash payment in today's valuation. This value is discounted to present value from the period that the payment will be made. |

N/A |

N/A |

| Interest Expense | Period Interest Amount |

|

The interest owed on the liability based on the discount rate. |

$8,287.54 Debit Interest Expense |

$8,287.54 Credit to Liability |

|

Asset Amortization Expense |

Period Asset Amortization Expense |

|

The amount that the asset value is reduced from one period to the next. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

$28,141.81 Debit to Rent Expense |

$28,141.81 Credit to ROU Asset Amortization |

| Liability Amortization Expense | Period Liability Amortization Expense | Not used in any journal entry | The amount that the liability value is reduced from one period to the next. In Report Builder currency conversions, this fields will be converted according to the foreign exchange rate record appropriate for each accounting period. That is, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of that accounting period. |

N/A |

N/A |

| Asset Balance | Asset Balance | Not used in any monthly journal entry |

This is the current value of the rented asset. The value of your asset is dependent upon whether you are calculating your lease as a Finance or Operating lease. Please see the Accounting Schedule Calculations page for more information. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

N/A |

N/A |

| Liability Balance | Liability Balance | Not used in any monthly journal entry |

This is the current value of the liability. The value of your liability is dependent upon whether you are calculating your lease as a Finance or Operating lease. Please see the Accounting Schedule Calculations page for more information. In Report Builder currency conversions, this field will be converted according to the foreign exchange rate record appropriate for each accounting period. That is, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of that accounting period. |

N/A |

N/A |

| 12-Month Forward Change in Asset Balance | 12-Month Forward Change in Asset Balance | Not used in any journal entry |

This is the sum of the asset amortization for the next 12 months. For customers using 4-4-5, 4-5-4, or 5-4-4 fiscal calendars with 13 periods, this field includes all 13 periods for the year. |

N/A |

N/A |

| 12-Month Forward Change in Liability Balance | 12-Month Forward Change in Liability Balance |

|

This is the sum of the liability amortization for the next 12 months. For customers using 4-4-5, 4-5-4, or 5-4-4 fiscal calendars with 13 periods, this field includes all 13 periods for the year. Note:

This is a reversing entry. The next month you would credit liability and debit short-term liability by the same amount from the month before. |

$281,571.76 Debit to Liability |

$281,571.76 Credit to Short-Term Liability |

Period Entries - Operating

Period Entries - Operating

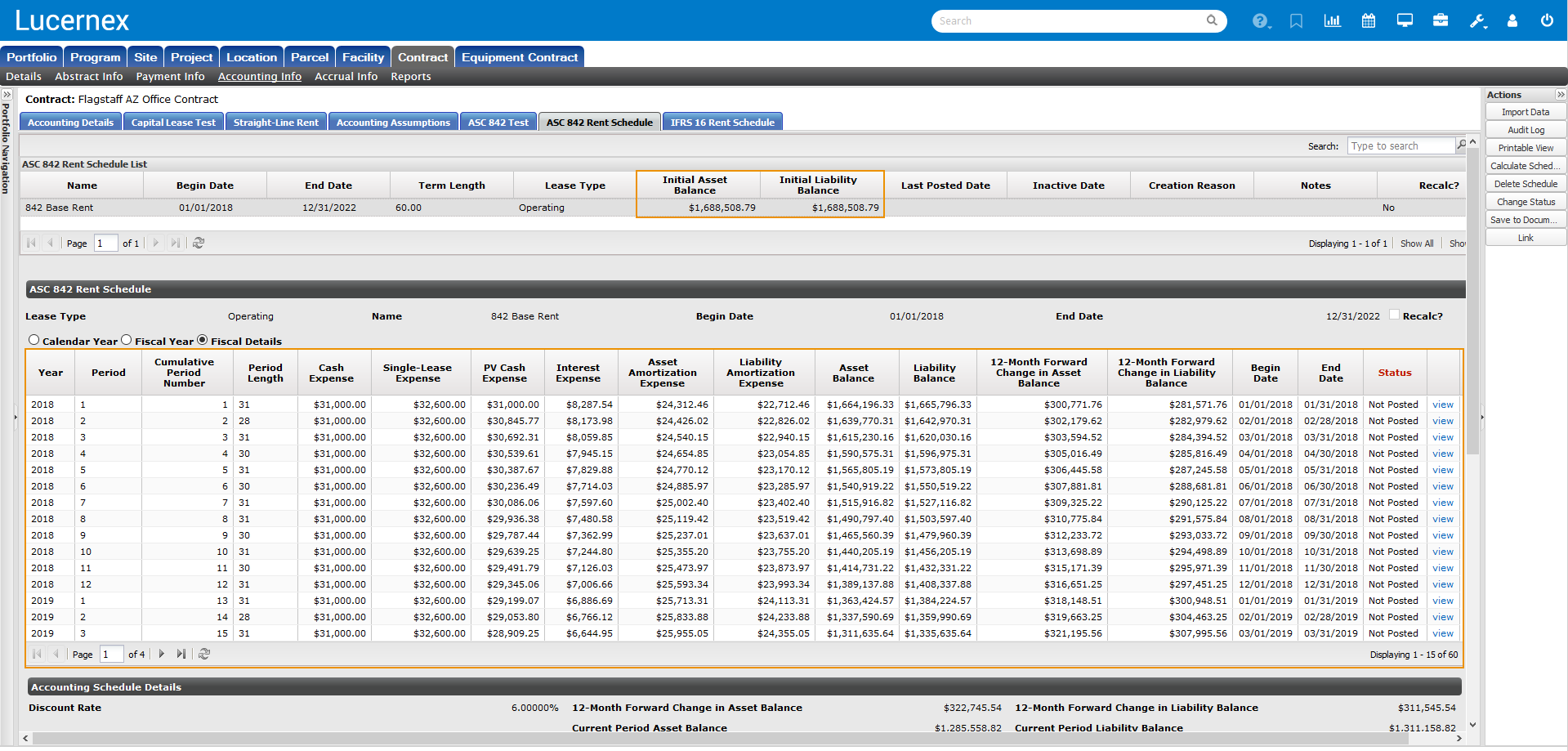

Pictured below is a screen shot of the Fiscal Details view of the Operating schedule we will be using in our example.

The table below shows the columns in the Fiscal Details table, their corresponding Report Builder field, typical journal entry item, description, and the debit and credit values for these items in Period 1 of the screen shot above.

The values in the Debit and Credit columns in the table below correspond with the screen shot above.

| Column in Fiscal Details | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

| Cash Expense | Period Cash Amount |

|

The amount of cash payments made during the period, fed directly from the recurring expense. |

$31,000.00 Debit to Liability |

$31,000.00 Credit to Rent Expense |

| Single Lease Expense | Period Expense Amount |

|

The cash rent straight lined over the life of the schedule. |

$32,600.00 Debit to Rent Expense |

$32,600.00 Credit to ROU Asset |

| PV of Cash Expense | PV Of Period Cash Amount | Not used in any journal entry | The Present Value of a future cash payment in today's valuation. This value is discounted to present value from the period that the payment will be made. |

N/A |

N/A |

| Interest Expense | Period Interest Amount |

|

The interest owed on the liability based on the discount rate. |

$8,287.54 Debit to ROU Asset |

$8,287.54 Credit to Liability |

|

Asset Amortization Expense |

Period Asset Amortization Expense |

Not used in this typical Operating journal entry |

The amount that the asset value is reduced from one period to the next. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

N/A |

N/A |

| Liability Amortization Expense | Period Liability Amortization Expense | Not used in any journal entry | The amount that the liability value is reduced from one period to the next. In Report Builder currency conversions, this fields will be converted according to the foreign exchange rate record appropriate for each accounting period. That is, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of that accounting period. |

N/A |

N/A |

| Asset Balance | Asset Balance | Not used in any monthly journal entry |

This is the current value of the rented asset. The value of your asset is dependent upon whether you are calculating your lease as a Finance or Operating lease. Please see the Accounting Schedule Calculations page for more information. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

N/A |

N/A |

| Liability Balance | Liability Balance | Not used in any monthly journal entry |

This is the current value of the liability. The value of your liability is dependent upon whether you are calculating your lease as a Finance or Operating lease. Please see the Accounting Schedule Calculations page for more information. In Report Builder currency conversions, this field will be converted according to the foreign exchange rate record appropriate for each accounting period. That is, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of that accounting period. |

N/A |

N/A |

| 12-Month Forward Change in Asset Balance | 12-Month Forward Change in Asset Balance | Not used in any journal entry |

This is the sum of the asset amortization for the next 12 months. For customers using 4-4-5, 4-5-4, or 5-4-4 fiscal calendars with 13 periods, this field includes all 13 periods for the year. |

N/A |

N/A |

| 12-Month Forward Change in Liability Balance | 12-Month Forward Change in Liability Balance |

|

This is the sum of the liability amortization for the next 12 months. For customers using 4-4-5, 4-5-4, or 5-4-4 fiscal calendars with 13 periods, this field includes all 13 periods for the year. Note:

This is a reversing entry. The next month you would credit liability and debit short-term liability by the same amount from the month before. |

$281,571.76 Debit to Liability |

$281,571.76 Credit to Short-Term Liability |

Scenario Two: Recalculation

Scenario Two: Recalculation

The values used in your recalculation journal entries appear in two areas in the user interface: in the Asset Amount and Liability Amount columns of the schedule you are recalculating, and in the Create New Schedule window.

The Asset Amount and the Liability Amount of the last posted period are used in the Recalculation journal entries.

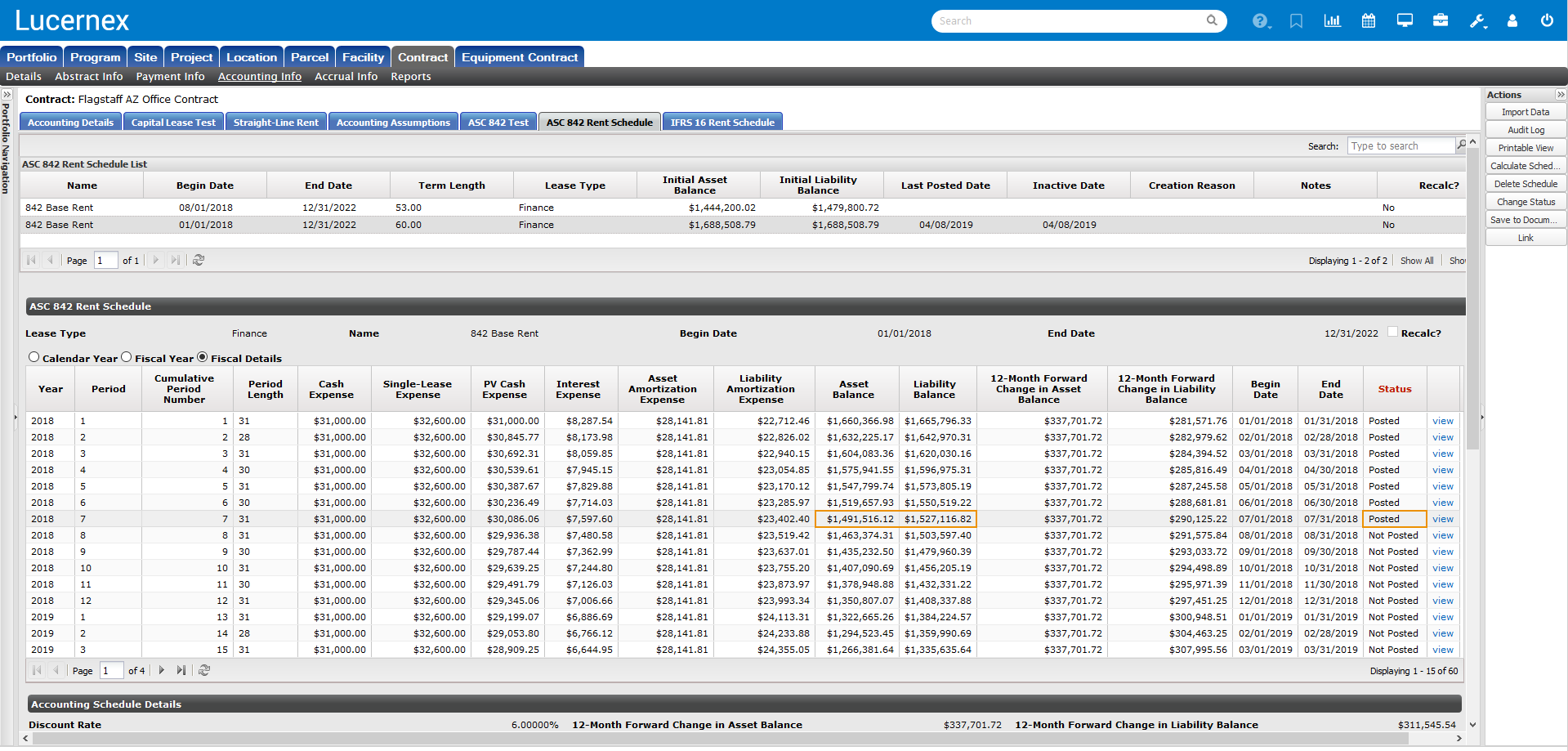

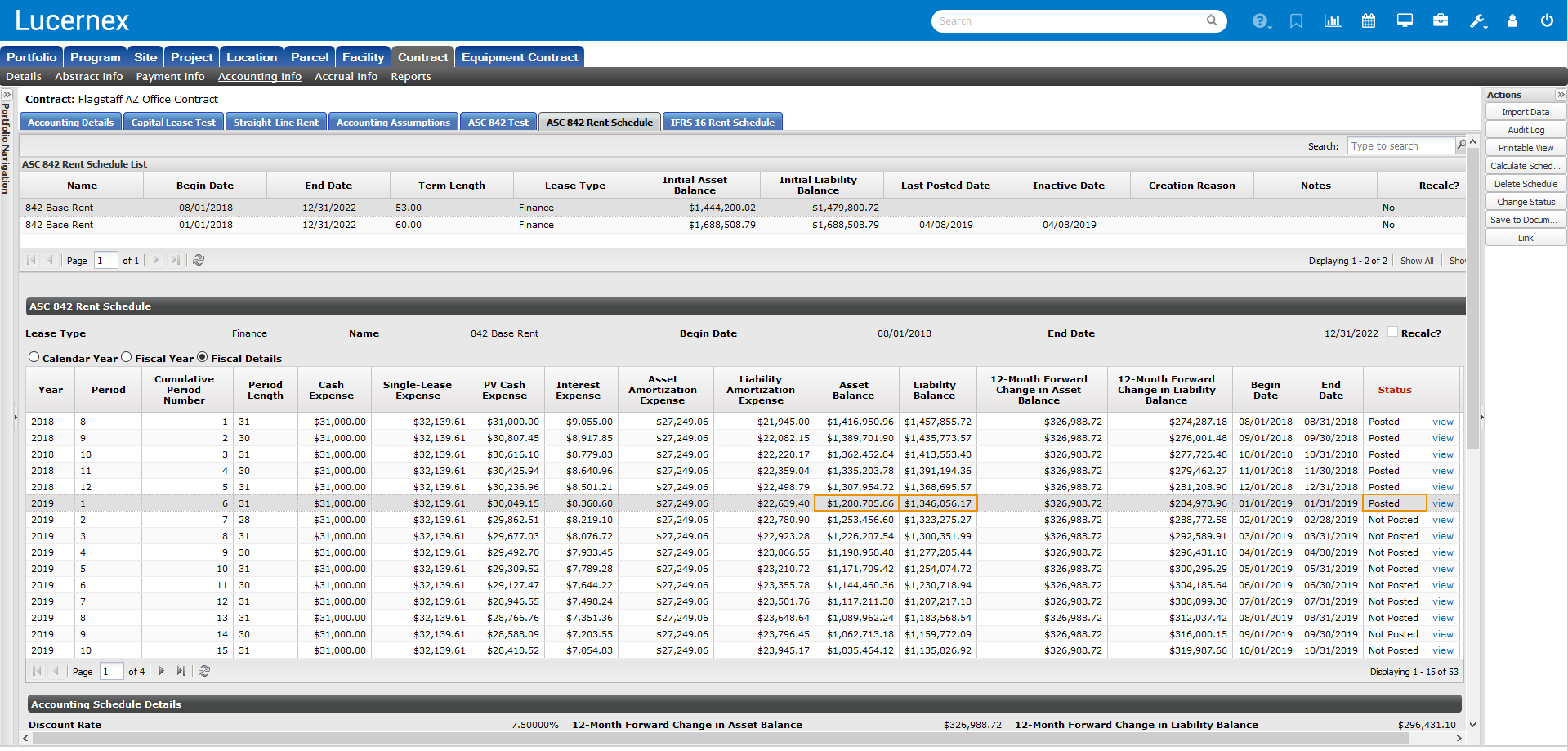

Pictured below is the ASC 842 Rent Schedule page. On the page is the Fiscal Details view of an ASC 842 Finance Schedule. The Asset Balance and Liability Balance of the last posted period are boxed in orange, to make them more visible.

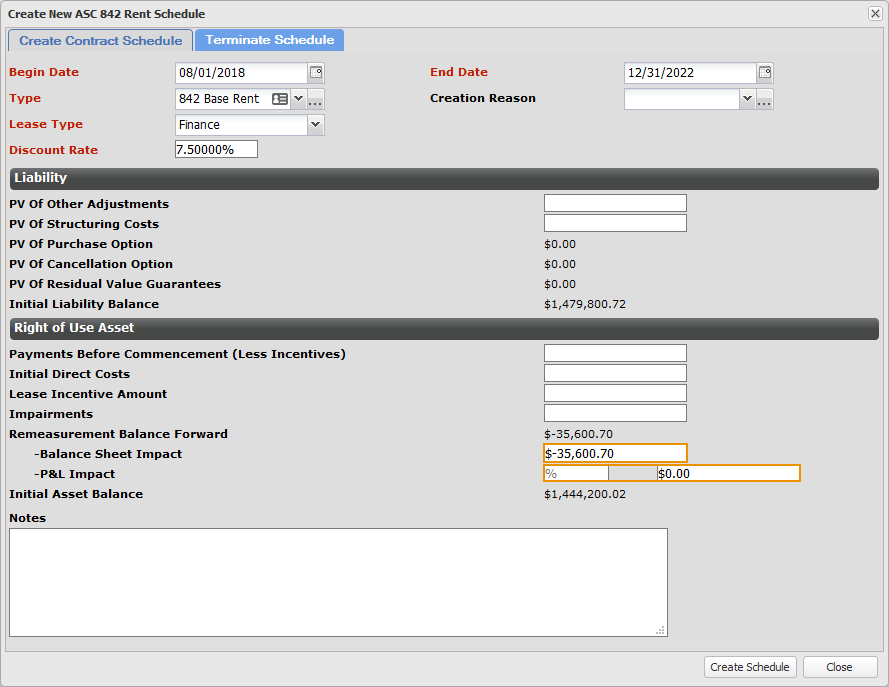

The Balance Sheet Impact and the P&L Impact fields are also used in your recalculation journal entries. Pictured below is the Create New ASC 842 Rent Schedule modal window. The Remeasurement Balance Forward fields are boxed in orange to make them more visible.

The values in the Debit and Credit columns in the table below correspond with the screen shots above.

| Item | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

|

Asset Balance* *from the previously posted period |

Asset Balance |

|

|

|

$1,491,516.12 Credit to ROU Asset |

|

Liability Balance* *from the previously posted period |

Liability Balance |

|

|

$1,527,116.82 Debit to Liability |

|

| Remeasurement Balance Forward | Balance Sheet Impact |

|

|

|

$35,600.70 Credit to ROU Asset |

| Profit and Loss Impact | Profit And Loss Impact |

|

|

Optional |

Optional |

Scenario Three: Termination

Scenario Three: Termination

The values used in your termination journal entries appear in two areas in the user interface: in the Asset Amount and Liability Amount columns of the schedule you are terminating, and in the Create New Schedule window.

The Asset Amount and the Liability Amount of the last posted period are used in the Termination journal entries.

Pictured below is the ASC 842 Rent Schedule page. On the page is the Fiscal Details view of an ASC 842 Finance Schedule. The Asset Balance and Liability Balance of the last posted period are boxed in orange, to make them more visible.

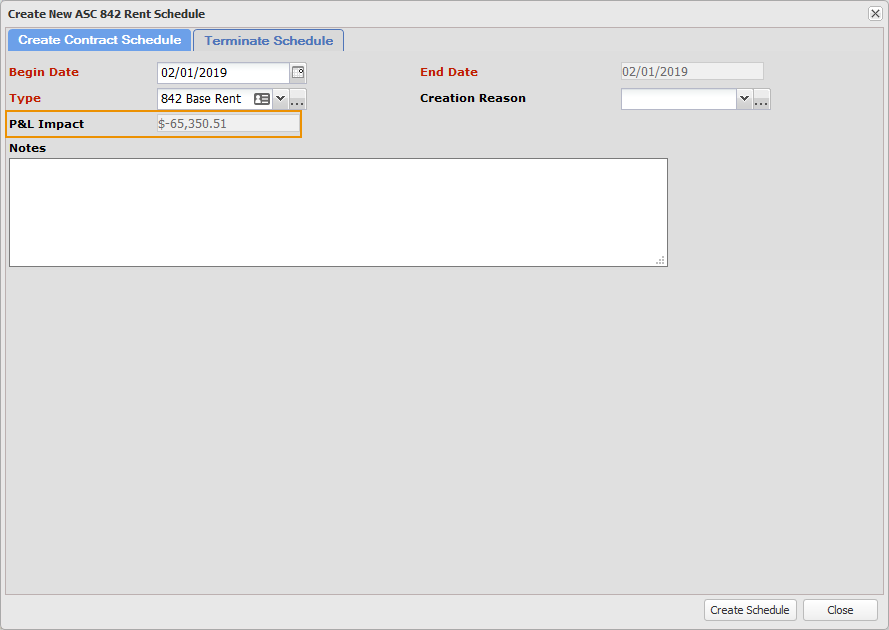

The P&L Impact is also used in your termination journal entries. Pictured below is the Terminate Schedule tab of the Create New ASC 842 Rent Schedule modal window. The P&L Impact is boxed in orange to make it more visible.

The values in the Debit and Credit columns in the table below correspond with the screen shots above.

| Item | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

|

Asset Balance* *from the previously posted period |

Asset Balance |

|

|

|

$1,280,705.66 Credit to ROU Asset |

|

Liability Balance* *from the previously posted period |

Liability Balance |

|

|

$1,346,056.17 Debit to Liability |

|

| Profit and Loss Impact | Profit And Loss Impact |

|

|

|

$65,350.51 Credit to P&L Loss Account |

Typically, if your liability exceeds your asset, your P&L impact will be a credit. If your asset exceeds your liability, your P&L impact will be a debit.

IFRS 16 or GASB 87 Scenarios

IFRS 16 or GASB 87 Scenarios

Scenario One: Initial Entry

Scenario One: Initial Entry

Inception Entries

Inception Entries

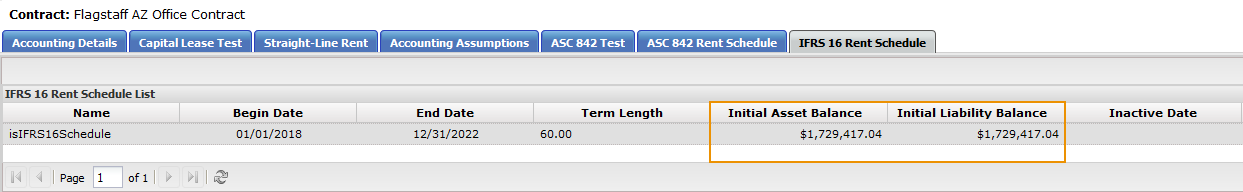

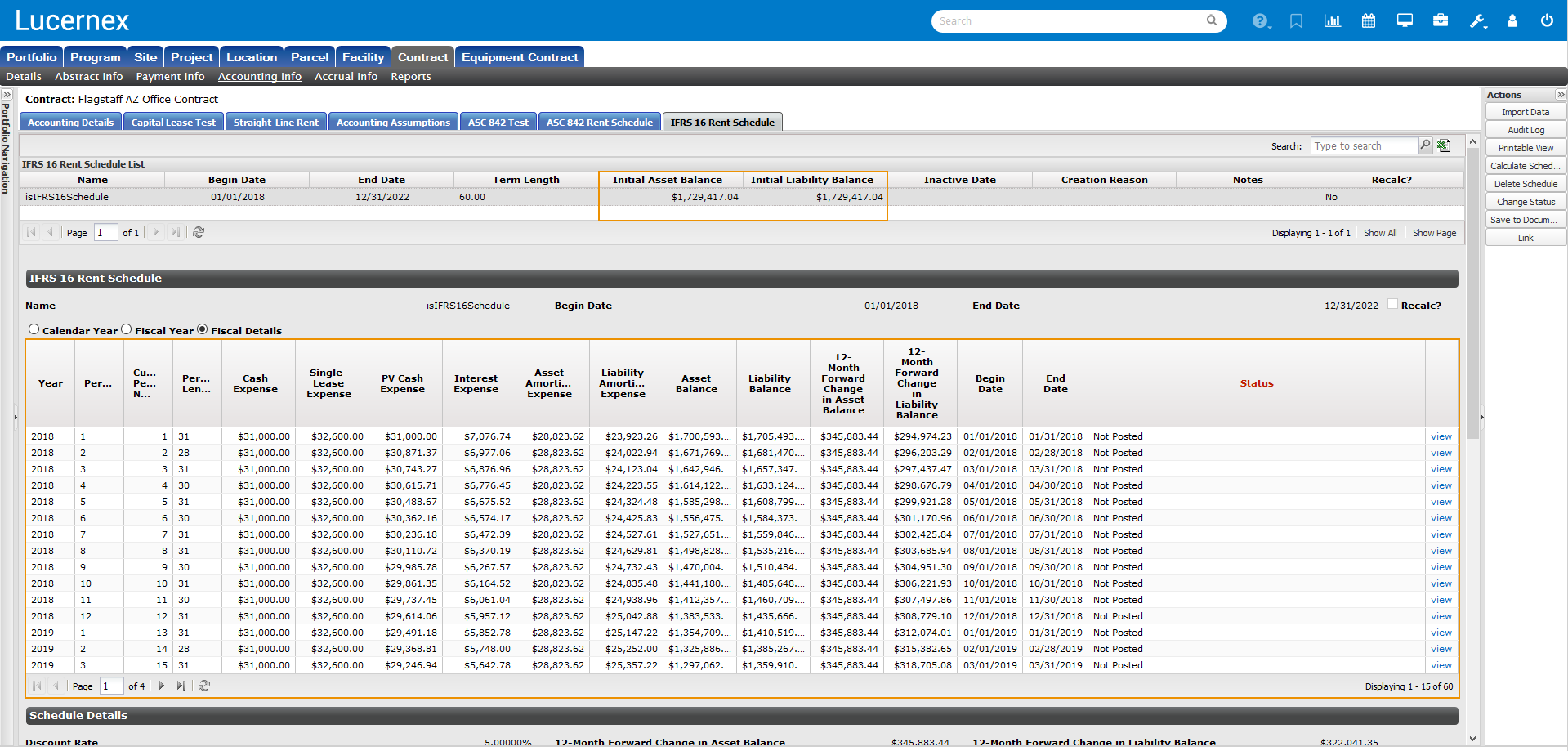

Generally speaking, the initial asset and liability balances are used to populate the entries at inception. The initial asset and liability balances appear in the Rent Schedule List. Pictured below is the IFRS 16 Rent Schedule List. The Initial Asset Balance is $1,729,417.04 and the Initial Liability Balance is $1,729,417.04.

The values in the Debit and Credit columns in the table below correspond with the screen shot above.

| Item | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

| Initial Asset Balance | Initial Asset Balance |

|

This is a calculated value which contains the initial value over the asset of the lease. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

$1,729,417.04 Debit to Initial Asset Balance |

|

| Initial Liability Balance | Initial Liability Balance |

|

This is the total of all of the Period Payment Present Values over the life of the lease. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

|

$1,729,417.04 Credit to Initial Liability Balance |

Period Entries

Period Entries

Pictured below is the IFRS 16 Rent Schedule page. On the page is the Fiscal Details view of an IFRS 16 Schedule.

The table below shows the columns in the Fiscal Details table, their corresponding Report Builder field, typical journal entry item, description, and the debit and credit values for these items in Period 1 of the screen shot above.

The values in the Debit and Credit columns in the table below correspond with the screen shot above.

| Column in Fiscal Details | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

| Cash Expense | Period Cash Amount |

|

The amount of cash payments made during the period, fed directly from the recurring expense. |

$31,000.00 Debit to Liability |

$31,000.00 Credit to Rent Expense |

| Single Lease Expense | Period Expense Amount |

Not used in any journal entry |

The cash rent straight lined over the life of the schedule. |

N/A |

N/A |

| PV of Cash Expense | PV Of Period Cash Amount | Not used in any journal entry | The Present Value of a future cash payment in today's valuation. This value is discounted to present value from the period that the payment will be made. |

N/A |

N/A |

| Interest Expense | Period Interest Amount |

|

The interest owed on the liability based on the discount rate. |

$7,076.74 Debit to ROU Asset |

$7,076.74 Credit to Liability |

|

Asset Amortization Expense |

Period Asset Amortization Expense |

|

The amount that the asset value is reduced from one period to the next. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

$28,823.62 Debit to Rent Expense |

$28,823.62 Credit to ROU Asset Amortization |

| Liability Amortization Expense | Period Liability Amortization Expense | Not used in any journal entry | The amount that the liability value is reduced from one period to the next. In Report Builder currency conversions, this fields will be converted according to the foreign exchange rate record appropriate for each accounting period. That is, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of that accounting period. |

N/A |

N/A |

| Asset Balance | Asset Balance | Not used in any monthly journal entry |

This is the current value of the rented asset. The value of your asset is dependent upon whether you are calculating your lease as a Finance or Operating lease. Please see the Accounting Schedule Calculations page for more information. In Report Builder currency conversions, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of the first accounting period. |

N/A |

N/A |

| Liability Balance | Liability Balance | Not used in any monthly journal entry |

This is the current value of the liability. The value of your liability is dependent upon whether you are calculating your lease as a Finance or Operating lease. Please see the Accounting Schedule Calculations page for more information. In Report Builder currency conversions, this field will be converted according to the foreign exchange rate record appropriate for each accounting period. That is, a foreign exchange rate record will be applied that has an effective date between the Begin Date and the End Date of that accounting period. |

N/A |

N/A |

| 12-Month Forward Change in Asset Balance | 12-Month Forward Change in Asset Balance | Not used in any journal entry | This is the sum of the asset amortization for the next 12 months. |

N/A |

N/A |

| 12-Month Forward Change in Liability Balance | 12-Month Forward Change in Liability Balance |

|

This is the sum of the liability amortization for the next 12 months. Note:

This is a reversing entry. The next month you would credit liability and debit short-term liability by the same amount from the month before. |

$294,974.23 Debit to Liability |

$294,974.23 Credit to Short-Term Liability |

Scenario Two: Recalculation

Scenario Two: Recalculation

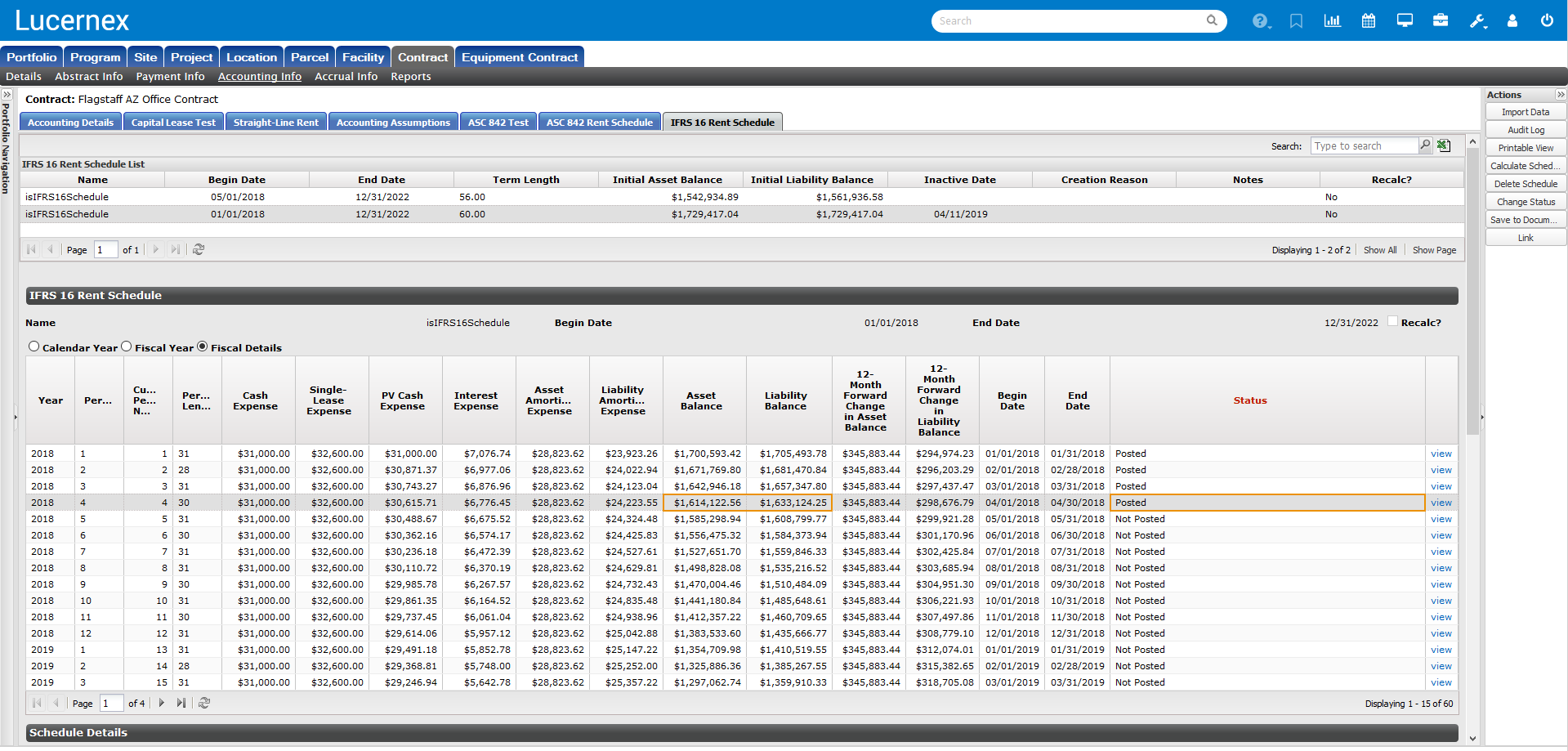

The values used in your recalculation journal entries appear in two areas in the user interface: in the Asset Amount and Liability Amount columns of the schedule you are recalculating, and in the Create New Schedule window.

The Asset Amount and the Liability Amount of the last posted period are used in the Recalculation journal entries.

Pictured below is the IFRS 16 Schedule page. On the page is the Fiscal Details view of an IFRS 16 Schedule. The Asset Balance and Liability Balance of the last posted period are boxed in orange, to make them more visible.

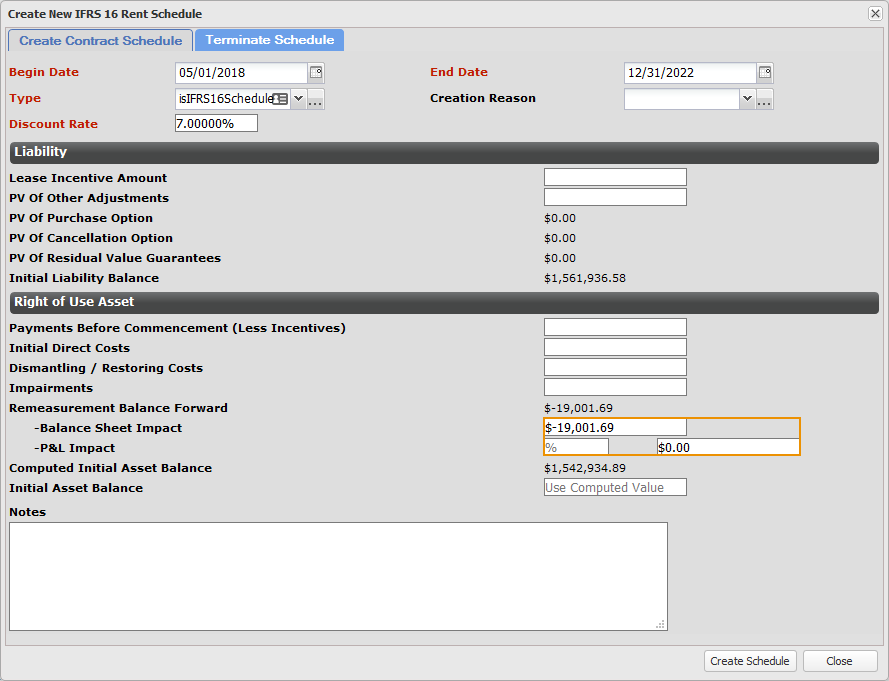

The Balance Sheet Impact and the P&L Impact fields are also used in your recalculation journal entries. Pictured below is the Create New IFRS 16 Rent Schedule modal window. The Remeasurement Balance Forward fields are boxed in orange to make them more visible.

The values in the Debit and Credit columns in the table below correspond with the screen shots above.

| Item | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

|

Asset Balance* *from the previously posted period |

Asset Balance |

|

|

|

$1,614,122.56 Credit to ROU Asset |

|

Liability Balance* *from the previously posted period |

Liability Balance |

|

|

$1,633,124.25 Debit to Liability |

|

| Remeasurement Balance Forward | Balance Sheet Impact |

|

|

|

$19,001.69 Credit to ROU Asset |

| Profit and Loss Impact | Profit And Loss Impact |

|

|

Optional |

Optional |

Scenario Three: Termination

Scenario Three: Termination

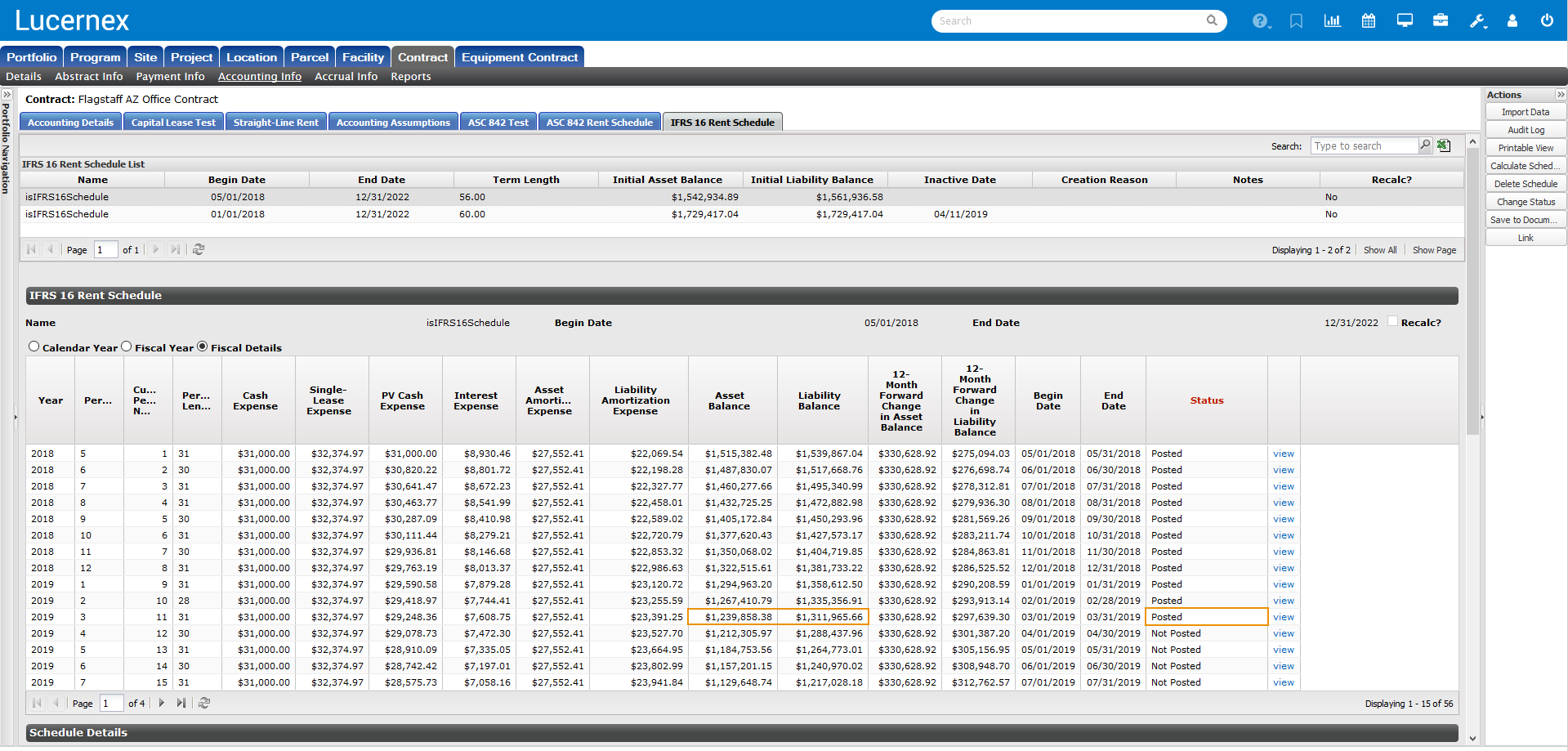

The values used in your termination journal entries appear in two areas in the user interface: in the Asset Amount and Liability Amount columns of the schedule you are terminating, and in the Create New Schedule window.

The Asset Amount and the Liability Amount of the last posted period are used in the termination journal entries.

Pictured below is the IFRS 16 Rent Schedule page. On the page is the Fiscal Details view of an IFRS 16 Schedule. The Asset Balance and Liability Balance of the last posted period are boxed in orange, to make them more visible.

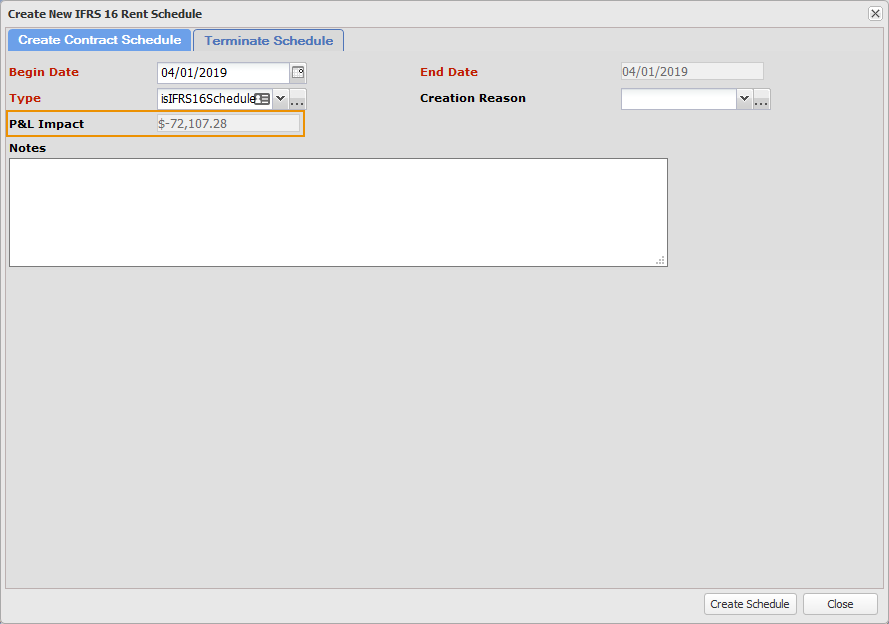

The P&L Impact is also used in your termination journal entries. Pictured below is the Terminate Schedule tab of the Create New IFRS 16 Rent Schedule modal window. The P&L Impact is boxed in orange to make it more visible.

The values in the Debit and Credit columns in the table below correspond with the screen shots above.

| Item | Report Builder Field | Typical Journal Entry Item | Description |

Debit |

Credit |

|---|---|---|---|---|---|

|

Asset Balance* *from the previously posted period |

Asset Balance |

|

|

|

$1,239,858.38 Credit to ROU Asset |

|

Liability Balance* *from the previously posted period |

Liability Balance |

|

|

$1,311,965.66 Debit to Liability |

|

| Profit and Loss Impact | Profit And Loss Impact |

|

|

|

$72,107.28 Credit to P&L Loss Account |

Typically, if your liability exceeds your asset, your P&L impact will be a credit. If your asset exceeds your liability, your P&L impact will be a debit.